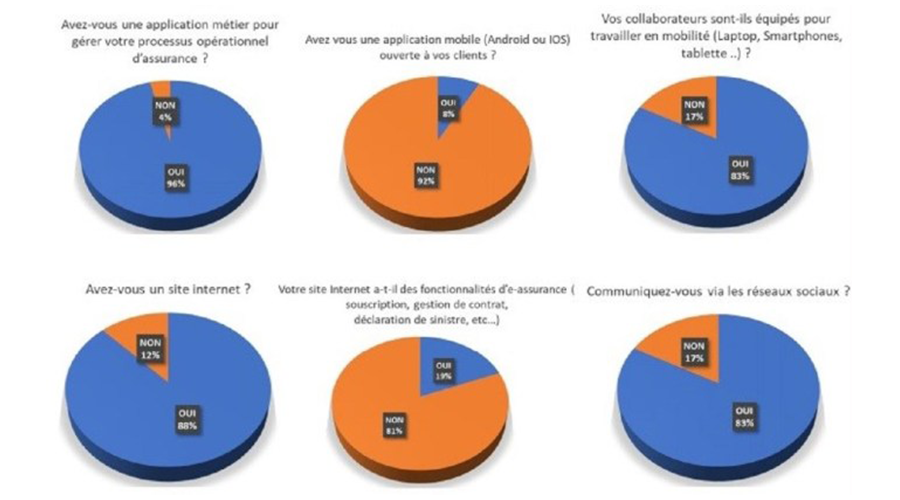

92% of insurance companies in the CIMA zone do not have mobile applications open to customers

Almost all companies (96%) have an insurance business application. Conversely, almost none (92%) have mobile applications open to customers. Lack of financial and technological resources is the main cause. At least for 42% of these companies. Lack of skills is the reason for 24%. Also, the vast majority of companies (88%) have a website. However, very few of them (19%) offer e-insurance functionalities on their website. And only 8% of these companies have a mobile application (android/ios) open to customers.

These are some of the findings of the study on the "Status of digitalization of insurance companies in the CIMA zone" conducted by KARBURA S.A. headed by Franck ASSOU and P2A headed by Protais AYANGMA, under the guidance of FANAF (Federation of African National Insurance Companies).

From November 2019 to January 2020, the study interviewed 52 insurance companies in the CIMA zone. The two firms have established ties with companies present in Benin (3), Burkina Faso (5), Cameroon (13), Central African Republic (1), Congo (3), Côte d'Ivoire (7), Gabon (2), Mali (3), Niger (4), Senegal (8) and Togo (3). The return rate for the questionnaires administered by Google forms was 32.5%.

Among the other results of the study, it is indicated that 100% of insurance companies claim to have ongoing or future projects around digital. Also, despite the fact that almost all companies (90%) have identified and designated an internal (Business Unit) or external (Service Provider) player as being in charge of their information system, very few (11.5%) have actually formalised all their procedures for using digital tools.

Furthermore, more than half of the companies (58%) state that senior management is intensely involved in the digital transformation process.

For the authors of this study, the main factors hindering the internal development of digitalization expressed by the companies paradoxically call for much more attention from the external environment. "However, while it is true that the availability of material, human and financial resources in terms of quality and quantity is a determining factor in the implementation of a prosperous e-insurance economy, it is essential to specify that the formalization of business processes and customer orientation are the keystones. Thus the solutions and digital transformation approaches of insurance companies will have little or no effectiveness if the insured is not at the centre and integrated into formal internal procedures," the authors of the study suggest.

Source: digitalbusiness.africa