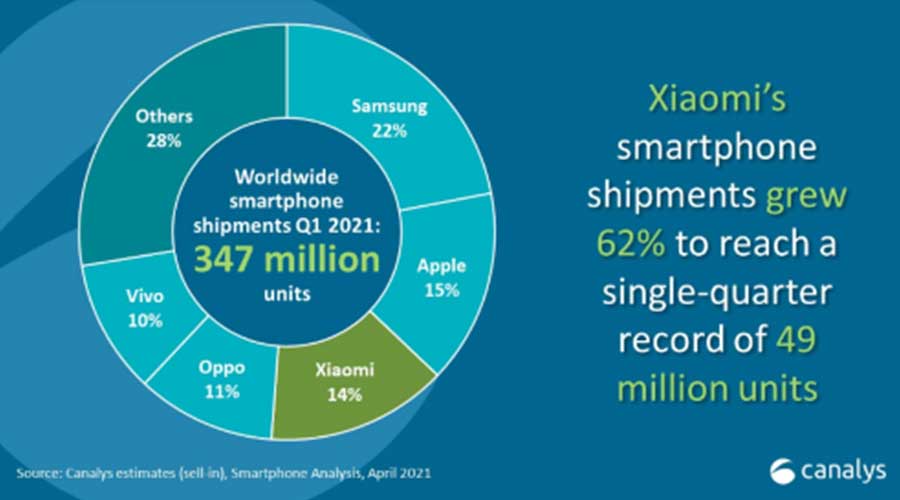

Global smartphone market grows by 27% in Q1 2021

In the first quarter of 2021, global smartphone shipments reached 347 million units, up 27% year-on-year. Samsung took the top spot, shipping 76.5 million, with a 22% share.

Apple shipped 52.4 million iPhones, to take a 15% share. Its iPhone 12 Mini sold below expectations, but the resilience of other iPhone 12 models, as well as stronger demand for the older iPhone 11, helped it maintain strong momentum.

Xiaomi posted its best quarterly performance ever, growing 62% and shipping 49.0 million units. Oppo and Vivo rounded out the top five, shipping 37.6 million and 36.0 million units respectively. Huawei, which no longer includes Honor, is now in seventh place with 18.6 million units, as the former world number one remains hampered by US sanctions.

"In addition to its excellent product value, Xiaomi is now focused on recruiting local talent, becoming more dealer friendly and leading the way in high-end innovation, as seen with the Mi 11 Ultra and its recent foldable device, the Mi Mix Fold," said Ben Stanton, research director at Canalys. "Its competitors offer a higher channel margin, but Xiaomi's sheer volume actually gives retailers a better opportunity to make money than rival brands. But the race is not over. Oppo and Vivo are hot on its heels, positioning themselves in the mid-range in many regions to block Xiaomi at the lower end. Honor is also a looming threat. It has already signed supply chain agreements and is in the process of signing distribution deals to return to several markets in the second half of 2021. Xiaomi is leading the pack, but the race is just beginning."

"LG, a pillar of the smartphone industry, is leaving the market this year," said Sanyam Chaurasia, analyst at Canalys. "It is a symbol of a new era in the smartphone market. It proves that an aggressive pricing and channel strategy is more important than hardware differentiation in the modern era." LG has the majority of its share in the Americas, accounting for 80% of its total in 2020, which presents new opportunities for the likes of Motorola, TCL, Nokia and ZTE, particularly at prices below US$200. As the smartphone market continues to consolidate, this will not be the last time incumbent vendors compete for the remnants of a defeated brand."

According to IDC, as the smartphone market recovers, a major shift is occurring in the competitive landscape. Huawei has finally broken out of the top five for the first time in many years, after suffering sharp declines under the increased weight of US sanctions. Chinese vendors Xiaomi, OPPO and Vivo are taking advantage of this to increase their market share compared to the previous quarter, placing them in 3rd, 4th and 5th position globally with 14.1%, 10.8% and 10.1% market share respectively. These three vendors are increasingly focusing on international markets where Huawei had been increasing its share in recent years.

In the low to medium price segment, these suppliers benefit most from Huawei's decline, while most of the share in the high-end segment goes to Apple and Samsung.

Samsung regained the top spot in Q1 21 with impressive shipments of 75.3 million and a 21.8% share. The new S21 series has worked well for Samsung, mainly due to a successful pricing strategy that shaved $200 off the launch price of last year's flagship.

"As Huawei continues to decline in the smartphone market, we also learned that LG is exiting the market altogether," said Ryan Reith, vice president of IDC's Worldwide Mobile Device Trackers programme. "The bulk of LG's volume was in the Americas, with North America accounting for more than 50 percent of its volume and Latin America another 30 percent. Although the vendor has lost ground in recent years, it still held 9% of the North American market and 6% of the Latin American market. Its withdrawal creates immediate opportunities for other brands. With competition fiercer than ever, especially at the lower end of the market, it's safe to assume that six to 10 brands are eyeing this opportunity."

Source: developpez.com

What are your thoughts on the decline of Huawei and LG?