Forest traceability: Cameroon encounters difficulties in launching the Sigif 2 application

Barely launched at the beginning of 2022, Cameroon's 2nd generation Computerized Forest Information Management System (Sigif 2), financed by the German Cooperation and the European Union (EU), is experiencing difficulties.

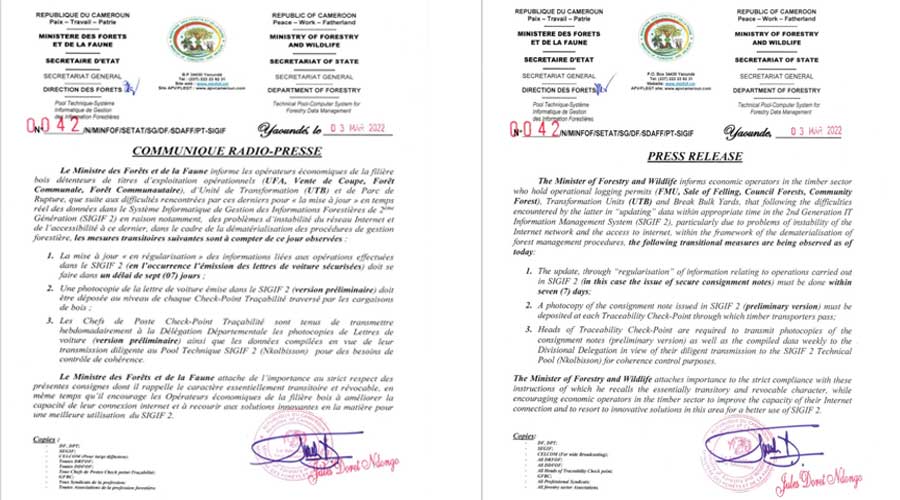

Indeed, in a statement issued on March 7, the Minister of Forests and Wildlife (Minfof), Jules Doret Ndongo, reveals that Sigif 2 has problems "updating" the data in real time due in particular to the instability of the Internet network and accessibility to it. Because of these difficulties, the member of the government prescribes transitional measures for economic operators in the timber sector who hold operational logging permits (sale of timber, communal forest, community forest ...).

The first of these measures allows operators to update "in regularization" the information related to operations carried out in Sigif 2 (in this case the issuance of secure letters) within seven days. The second transitional measure prescribed is that a photocopy of the waybill (a contract for the transport of goods that binds the shipper, the freight forwarder and the carrier) issued in Sigif 2 must be deposited at each "Traceability" checkpoint crossed by timber shipments. The last transitional measure stipulates that the heads of checkpoints are required to transmit weekly to the departmental delegation of the Ministry, photocopies of the consignment notes (preliminary version) as well as the compiled data for their diligent transmission to the Sigif 2 technical pool in Nkolbisson, a suburb of Yaoundé, for control and consistency purposes.

In announcing the implementation of Sigif 2, at the end of 2021, Minfof indicated that this new application will allow for an increase in revenue from forestry taxes. Thus, it is projected an increase of 25 and 30% for the felling tax due to the control of the real taxable forest production of each forest operator and the consideration of all sources of timber supply. In addition, this digital traceability will promote, according to Minfof, the identification, beyond traditional forest taxes, of new revenue niches through the issuance of certificates of legality, Flegt authorizations and the computer fee.

According to the Directorate General of Taxes, over the period 2018-2019, forestry companies in Cameroon had a tax yield of CFAF 100.3 billion, 50.9 billion in 2018 and 49.4 billion CFAF in 2019. However, the Ministry of Finance indicates that the potential amount of forestry taxes not paid to the public treasury reached FCFA 5.1 billion in 2018 and FCFA 4.8 billion in 2019, a total of FCFA 9.9 billion over the two years.

The German Cooperation and the EU have expressed reservations about this application. For these two donors, the certificates issued by Sigip 2 can not be recognized or validated under the European Union Timber Regulation (Rbue), let alone in the context of future Flegt authorizations, without a complete overhaul of the tool, based on a benchmark study conducted with the Ministry of Economy.

Source : Investiraucameroun